Stock picking isn't dead, but it's evolving. In 2025, AI-driven tools and algorithmic trading are reshaping how investors choose stocks, challenging traditional methods like fundamental and technical analysis. Here's what you need to know:

- AI's Role: Platforms like AlphaSense process massive datasets, offering speed, precision, and real-time insights that humans can't match. AI now drives 70-80% of U.S. stock market activity.

- Challenges for Humans: Emotional investing, data overload, and market complexity make manual stock picking harder. 92% of large-cap funds underperformed the S&P 500 over 15 years.

- Best Approach: Combine AI's data power with human judgment. Let AI handle analysis while humans focus on strategy and qualitative factors.

The future of investing lies in blending AI with human expertise for better results.

AI can pick stocks better than experts?

The Shift from Human Intuition to AI in Stock Picking

Stock picking has seen a major transformation, moving from traditional human analysis to advanced AI-driven methods. This change has reshaped investment strategies in recent years.

Traditional Stock Picking Methods

In the past, stock picking relied heavily on fundamental analysis - examining financial statements and industry trends. Warren Buffett's value investing is a classic example of this approach. Investors also used technical analysis, like studying chart patterns, and considered qualitative factors such as management quality. However, these manual methods are increasingly being replaced by AI systems that can process vast amounts of data much faster and more efficiently.

The Rise of AI and Algorithmic Trading

Unlike traditional approaches that depend on human judgment, AI offers a systematic, data-driven alternative. AI systems now analyze enormous datasets in real time, changing how stocks are evaluated. For instance, AlphaSense is widely used by 88% of S&P 500 companies and 80% of top asset management firms [3]. This tool showcases how AI has improved the speed and precision of stock analysis, making it a game-changer for investment research.

What This Means for Investors

The shift to AI has brought both opportunities and challenges for investors:

For Individual Investors:

- Access to tools that provide real-time data analysis, previously only available to institutions

- Better ability to spot market trends and patterns

For Institutional Investors:

- Use of AI for portfolio management and risk evaluation

- Faster decisions driven by data insights

Rather than replacing human investors, AI is changing how they operate. The best strategies now combine AI's computational power with human expertise, creating a partnership where technology and intuition work together to navigate the market more effectively.

Challenges of Manual Stock Picking in Today's Markets

Investors today are drowning in data - financial reports, real-time updates, breaking news - making it harder than ever to make clear, rational choices. This deluge of information often leads to "analysis paralysis", as investment behavior expert Julie Agnew explains:

"Simply providing people with information about investment options may not be enough to produce rational and sound decisions."

The markets have also become far more complex. Consider this: in the 1960s, individual investors made up 90% of stock purchases. Fast forward to today, and that figure has plummeted to just 10%, with institutional investors and their sophisticated strategies taking the lead. Hedge funds, algorithmic trading, and other advanced tools now dominate the landscape, making it a completely different ballgame.

Another major hurdle? Emotional decision-making. Independent trader Chris Andreou puts it bluntly:

"Trading based on emotion will consistently lead to the same unsatisfactory results."

The data backs this up. Over a 15-year period, nearly 92% of large-cap funds underperformed the S&P 500 [1]. Larry Swedroe, Chief Research Officer for Buckingham Wealth Partners, explains why:

"Active managers need victims they can exploit, and that usually means retail investors."

Recent research on 568 of the largest U.S. stocks paints a clear picture: while the average stock return was 12.2%, the median return was only 0.8% [1]. This gap shows how emotional investing often leads people to chase high-performing outliers, ignoring steadier, more reliable options.

When overwhelmed by too much information, many investors default to simpler - but less effective - choices. As markets grow increasingly complicated, traditional methods just can't keep up. This is where AI steps in, offering tools that can process massive amounts of data quickly and eliminate emotional bias. AI-powered stock screening is proving to be a game-changer in addressing these challenges.

sbb-itb-5d8d242

AI-Driven Stock Screening Tools: Improving Efficiency and Accuracy

AI systems are transforming stock analysis by identifying patterns and insights that are often difficult for humans to spot. These tools aren't meant to replace human investors but to provide them with faster, more detailed analysis.

How AI Platforms Work

AI stock screening platforms rely on machine learning to process financial data, market trends, and news sentiment all at once. They identify patterns and correlations that influence stock performance. This approach has become increasingly popular, with algorithmic trading now accounting for 70-80% of U.S. stock market activity.

Stocks to Buy Constellation: A Case in Point

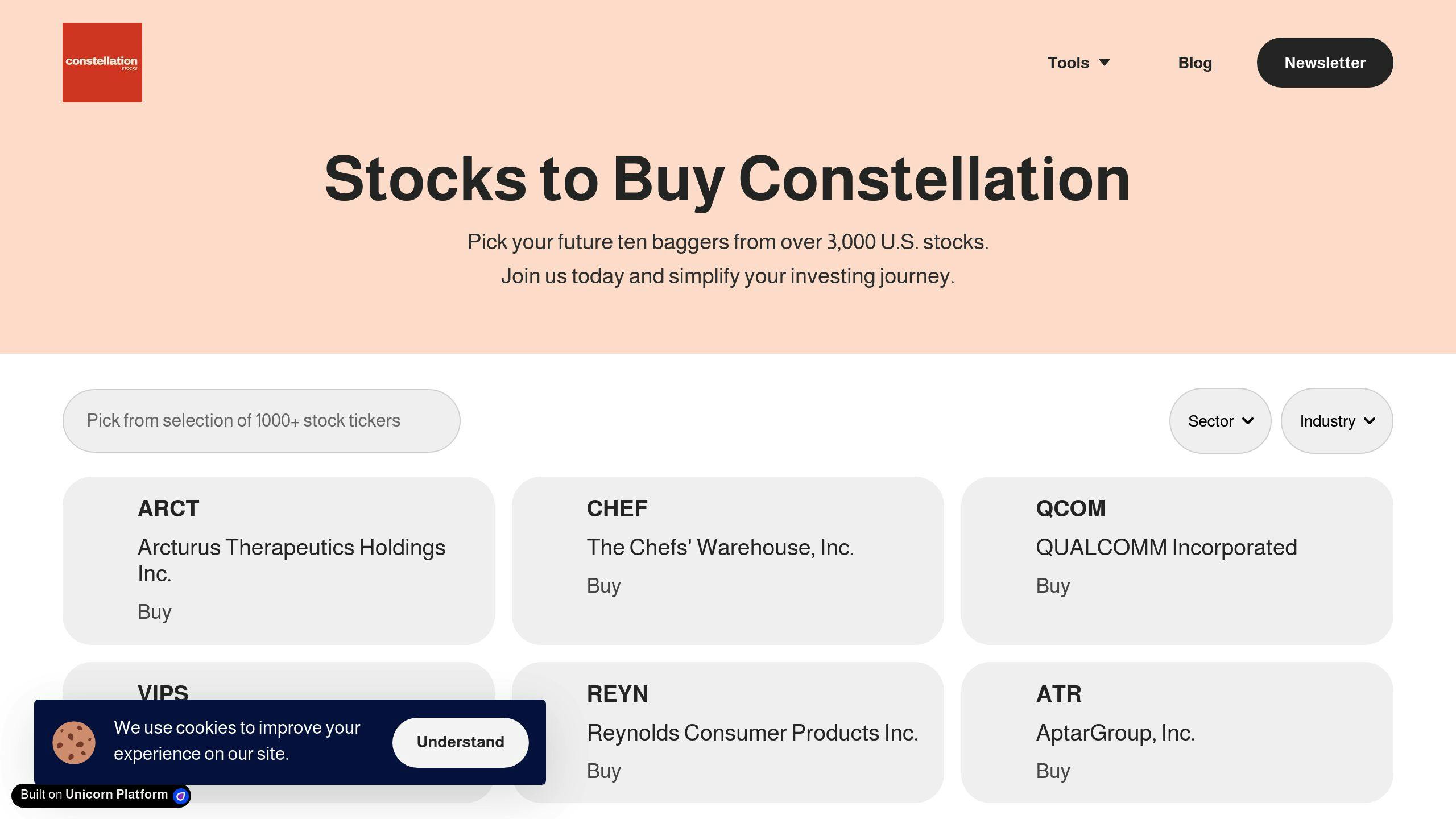

Stocks to Buy Constellation is an AI-powered platform that offers tools for research, real-time portfolio tracking, industry analysis, and statistical evaluation. It's designed for both individual and professional investors, covering 3,000 U.S. stocks with daily updates and proprietary valuation models.

Why AI Stock Screening Stands Out

AI stock screening tools excel in speed, consistency, and recognizing patterns. They can analyze thousands of stocks in minutes, provide unbiased evaluations, and detect subtle market trends. Unlike traditional methods, AI can process diverse data sources, including social media sentiment, for a more comprehensive view.

Advancements in the technology now include natural language processing, enabling systems to analyze company announcements, social media activity, and news reports. While AI delivers impressive efficiency, its real strength lies in enhancing human decision-making, creating a well-rounded approach to stock selection.

Combining AI with Human Expertise: A Balanced Approach

Research from the University of Chicago Booth School of Business and Sean Cao's study (2001-2018) shows that AI and human analysts shine in different areas. AI delivers higher predictive accuracy (60%) compared to human experts (53-57%). However, when AI's data-driven insights are combined with human expertise - like assessing company culture or reacting to unexpected market changes - the results consistently surpass AI-only models.

For investors, the key to using AI tools effectively lies in dividing tasks thoughtfully. Let AI handle the heavy lifting of data processing and pattern recognition, while humans focus on qualitative analysis and strategic decisions. Here's a simple breakdown:

- AI tackles market data analysis, spots patterns, and provides quantitative insights.

- Humans define investment goals, assess company fundamentals, and weigh external factors.

- Together, AI recommendations are refined with human judgment shaped by experience and broader market understanding.

"The biggest takeaway from the research is just how strong the outcome can be when people work with AI", says Sean Cao, Director and Co-founder of Smith's AI Initiative for Capital Market Research [2].

Platforms like Danelfin and AltIndex show how effective this partnership can be. Danelfin's hybrid model has consistently outperformed the S&P 500, while AltIndex has achieved impressive win rates by blending AI analysis with human oversight. These examples highlight the value of combining machine precision with human insight.

This collaborative approach is gaining momentum. In fact, 80% of executives believe that merging human and machine intelligence leads to better outcomes. As the investment world continues to evolve, this blend of AI-driven accuracy and human intuition offers a powerful way forward.

Conclusion: The Future of Stock Picking

Key Takeaways for Investors

The traditional methods of stock picking are being challenged by the sheer volume of available information, but AI tools are stepping in to transform the process. According to Goldman Sachs, AI could contribute to a 7% boost in global growth over the next decade. The real value lies in how technology works alongside human judgment, not as a replacement.

The Role of Technology and Human Insight

The art of successful stock picking depends on blending advanced technology with human expertise. As AI continues to evolve, this partnership will play a critical role in shaping how investment strategies are developed and executed.

Looking Ahead

The investment world is on the brink of more change as new technologies emerge. The growing demand for digital services, cloud computing, and 5G is pushing the need for expanded data center capacity. Meanwhile, tools like agentic AI and quantum computing promise to make stock screening more precise and detailed. These advancements mark the next chapter in the evolution of stock picking, offering investors even more powerful tools.

To thrive in this changing environment, investors must embrace new technologies while maintaining human oversight. The future of investing isn't about choosing between AI and human insight - it’s about combining them to build stronger, more effective strategies. As markets grow more complex, this balanced approach will become essential for navigating and succeeding in stock picking.